Get Rid of the Filing Cabinet & Toss the Receipts. Tax organization and Cloud Systems.

Software used:

Excel or Sheets

Dropbox

We are just about at a $1M a year gross receipts in rental income. Although we use a more formal accounting package now, the system I am explaining here served us well into 60+ units. We still use dropbox today for storage and are 99% cloud based. The only business papers we keep filed are the deeds/notes/mortgages, and taxes. EVERYTHING else is cloud based. Everything.

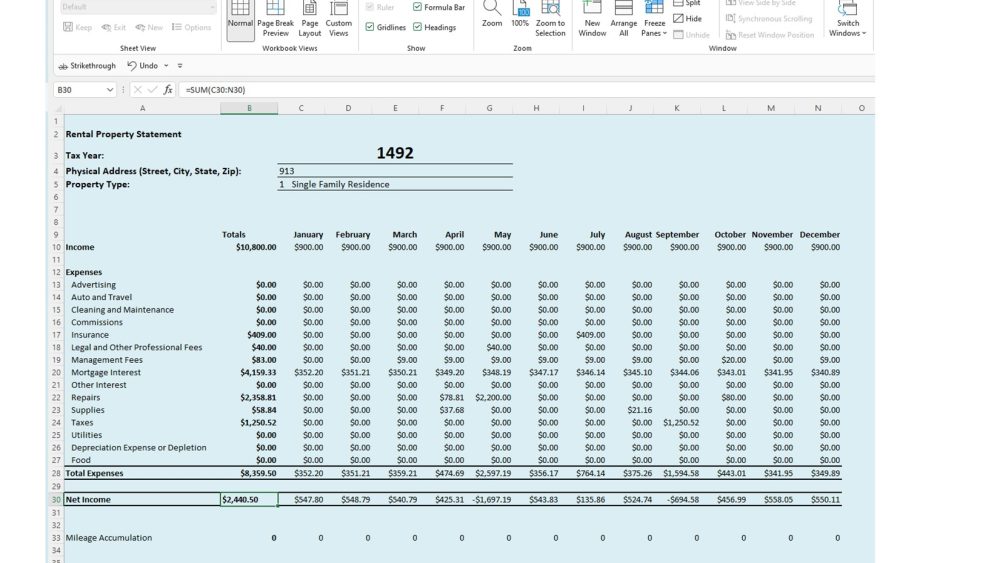

We created a spreadsheet that is identical to the Schedule E tax form used for income properties. Picture a worksheet with 13 tabs… first tab is a summary page that pulls data entered into the following 12 tabs that represent each month.

Dropbox. The free version will work perfectly for most folks. Make a folder for each property. Inside that folder, store all your files… HUD forms, closing packets, insurance packets, any property specific files you want to keep, then also another folder named “1206 Receipts” or whatever the address is. The word “Receipts” is important though because of how Dropbox displays folders in the app.

Steps:

- Each property gets a spreadsheet. Enter income/expenses in the correct month and category. This feeds the summary page. Simple as that. At the end of the year, print off the summary page and submit to your CPA.

- If expense; take a picture of the bill or receipt and put it into your Dropbox folder for the property in its “1206 Receipts” folder as mentioned above. Toss the receipt. No more pissed off CPAs or shoe boxes full of receipts. Do this immediately and dramatically improve the efficiency of your business.

This form is available on our store for quick purchase & download – Here

Dropbox is free.